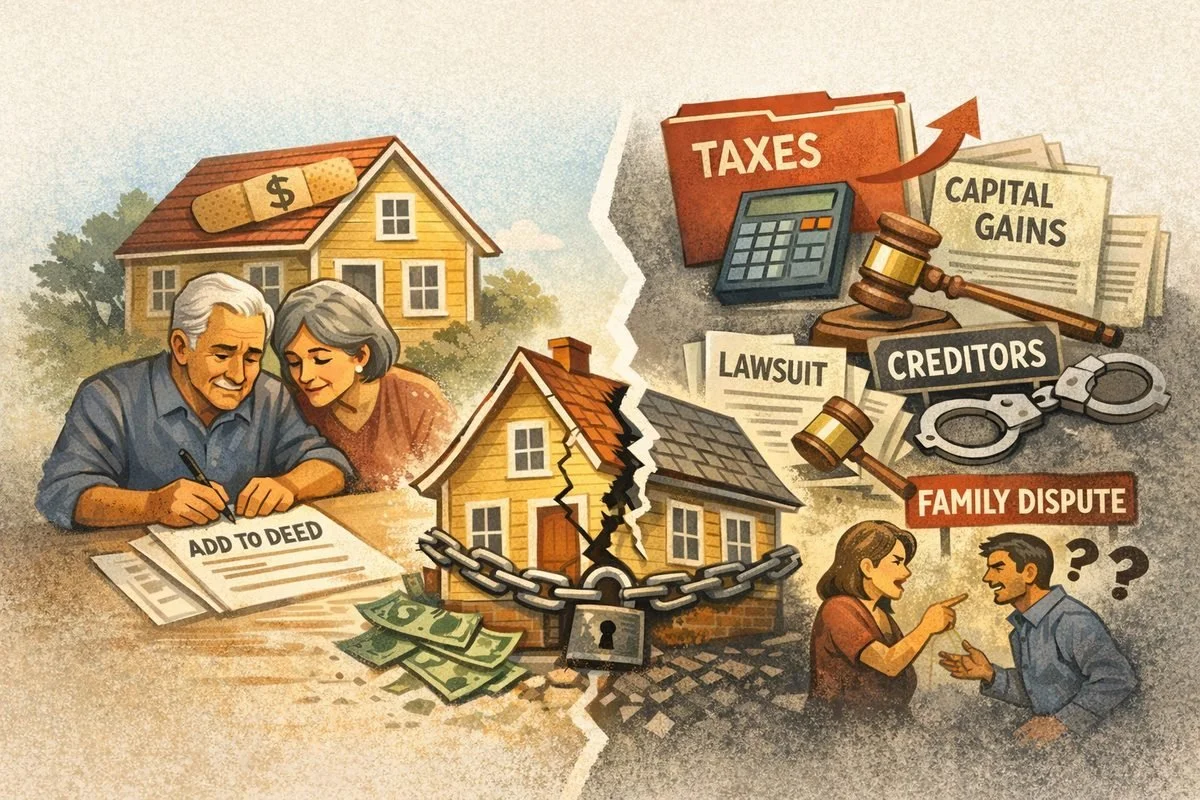

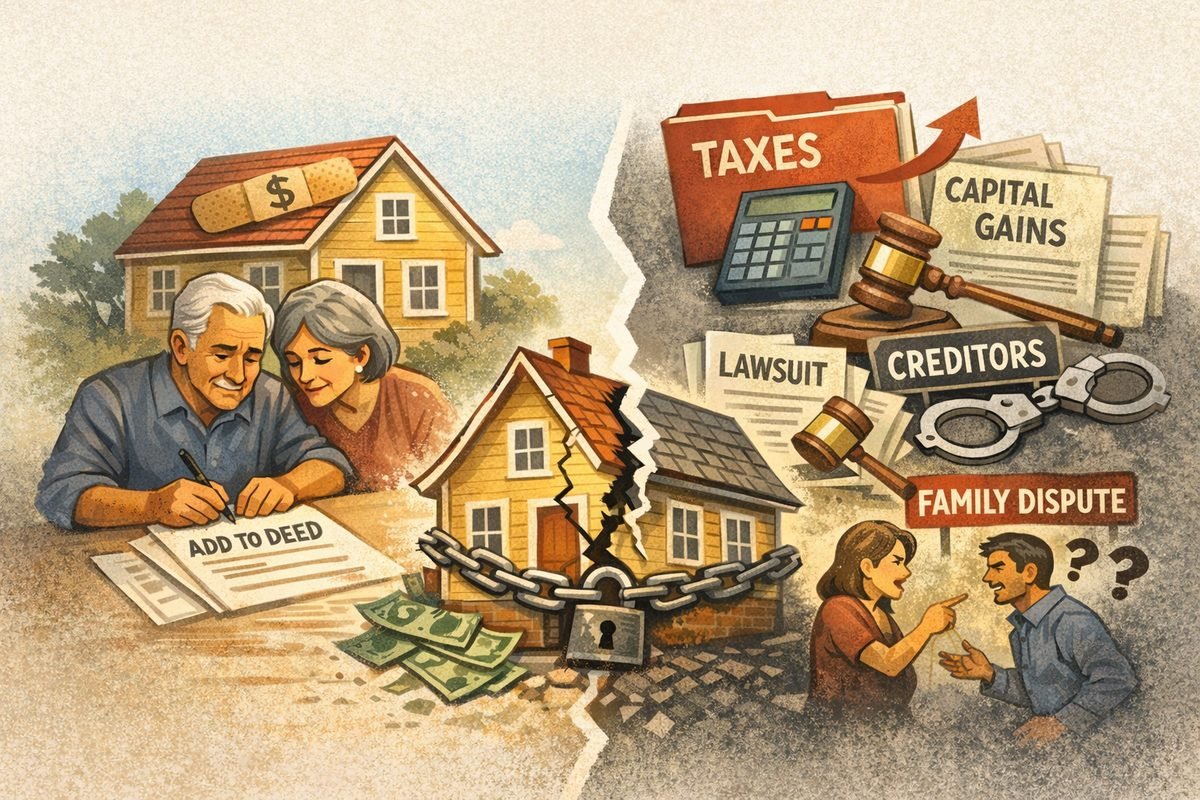

Adding a Family Member to a Deed: A Cheap Shortcut to Very Expensive Estate Planning Mistakes

Risks of adding a family member to a property deed, including taxes, creditors, and family disputes.

Homeowners frequently look for simple, inexpensive ways to pass real estate to their children or other family members. One of the most common suggestions they hear—often from friends, relatives, or online sources—is to “just add them to the deed.” While this approach may appear straightforward, it is one of the most problematic estate planning shortcuts a property owner can take.

Adding a family member to a deed is not a future planning tool. It is a present legal transfer with immediate and often irreversible consequences. In most cases, the downsides dramatically outweigh any perceived savings when compared to a properly structured will or trust.

Table of Contents

- Why People Add Family Members to Deeds

- An Immediate Transfer of Ownership

- Loss of Control and Flexibility

- Capital Gains and Tax Consequences

- Exposure to Creditors and Legal Claims

- What Happens When Family Dynamics Change

- Why Wills and Trusts Are Better Solutions

- When to Speak With an Estate Planning Attorney

Why People Add Family Members to Deeds

The motivation behind adding a family member to a deed is usually well intentioned. Homeowners often believe it will help them avoid probate, save money on legal fees, or make the transfer of property “automatic” at death.

What is rarely explained is that this approach does not delay ownership until death. Instead, it creates an immediate ownership interest with legal consequences that begin the moment the deed is recorded.

In estate planning, simplicity is not measured by how quickly something can be done, but by how well it protects the owner, the property, and the family over time.

An Immediate Transfer of Ownership

When a family member is added to a deed, the transfer is effective immediately. The added individual becomes a legal owner of the property as of the recording date. This is true whether the transfer was intended as a gift, an inheritance substitute, or a planning shortcut.

As a result:

- The new owner gains legally enforceable property rights

- The original owner no longer has sole control over the property

- The transfer cannot be undone without the consent of all owners

This means the property cannot be sold, refinanced, or mortgaged without the cooperation of the person added to the deed. Even if the homeowner paid for the property entirely and continues to live there, the legal ownership is now shared.

Loss of Control and Flexibility

Estate plans should adapt to life changes. Family relationships evolve, financial circumstances shift, and future needs are often unpredictable. Once a family member is added to a deed, flexibility is significantly reduced.

If circumstances change, the property owner may discover that:

- The ownership arrangement no longer reflects their wishes

- They cannot revise the plan unilaterally

- They are legally dependent on another person’s consent

By contrast, a will or trust allows the owner to retain complete control during life, while preserving the ability to revise beneficiaries and instructions as circumstances evolve.

Capital Gains and Tax Consequences

Tax consequences are one of the most misunderstood aspects of deed transfers. When real estate passes through an estate or trust at death, beneficiaries generally receive a step-up in cost basis to the fair market value as of the date of death.

This adjustment can significantly reduce or eliminate capital gains tax when the property is later sold.

When a family member is added to a deed during life:

- The transfer may be considered a taxable gift

- The recipient often receives the original cost basis

- A later sale can result in substantial capital gains liability

In many cases, families attempt to avoid modest probate costs only to incur far greater tax exposure later. This outcome is not only avoidable—it is common when planning is done without professional guidance.

Exposure to Creditors and Legal Claims

Adding a person to a deed exposes the property to that person’s financial risks. Once someone becomes an owner, their creditors may gain access to the property.

This risk exists even if the added owner:

- Never lived in the property

- Never contributed financially

- Was added solely for estate planning purposes

If the added owner is sued, files for bankruptcy, or becomes subject to a judgment, creditors may be able to place liens on the property or otherwise interfere with ownership.

Proper estate planning seeks to insulate property from these risks, not invite them.

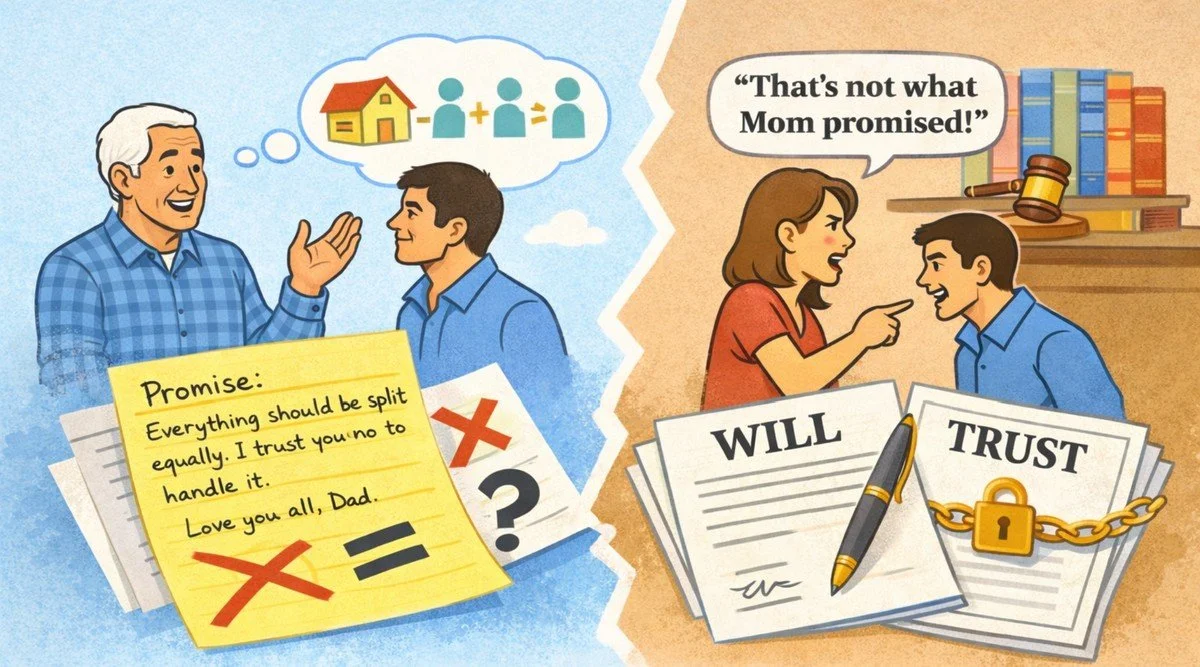

What Happens When Family Dynamics Change

Estate planning decisions are often made during periods of family harmony. Unfortunately, harmony cannot be guaranteed indefinitely. Adding a family member to a deed assumes permanent trust and cooperation.

Disputes frequently arise over:

- Whether the property should be sold

- Who is responsible for expenses and maintenance

- What happens if one owner needs cash or leverage

These conflicts can escalate into litigation, creating emotional and financial strain that far exceeds the cost of proper planning from the outset.

Why Wills and Trusts Are Better Solutions

Wills and trusts exist specifically to address the problems that deed transfers create. They allow property owners to maintain full control during life while clearly defining how property should pass at death.

Proper planning can:

- Preserve flexibility

- Minimize tax exposure

- Reduce family conflict

- Protect property from third-party claims

In many cases, the cost of preparing a will or trust is modest compared to the risks avoided. What initially appears to be a savings by adding a name to a deed often becomes an expensive mistake.

When to Speak With an Estate Planning Attorney

Before adding anyone to a deed, property owners should fully understand the legal and financial consequences. Once a deed is recorded, the damage may already be done.

If you are considering adding a family member to a deed—or if you have already done so and have concerns— a careful review of your situation is essential.

To discuss your options and develop a plan that protects your property, your family, and your long-term goals, you are encouraged to schedule a consultation.

To make an appointment, please contact Nicholas S. Ratush, P.C. to discuss your estate planning needs.