Who Keeps the Originals? How to Store, Share, and Talk About Your Estate Planning Documents in Massachusetts

“After getting her hearing aid fixed, grandma rewrote her will three times.” It’s a funny line, but there’s a serious lesson underneath: your will—and the rest of your estate planning—are only as good as the way the originals are kept, the way copies are shared, and the way your family learns what to do when the time comes. A beautiful document doesn’t help if the original can’t be found, if staples were removed, or if no one knows who has a key to the safe.

In This Post

- Why keeping originals pristine matters (and why you should never un-staple or hand-edit)

- Who needs to know where things are (PRs, trustees, agents) and how to tell them

- Reducing drama when the plan isn’t “equal”: making your will unassailable

- Massachusetts timing: contests, capacity, and using notice the right way

1) Why keeping originals pristine matters (and why you should never un-staple or hand-edit)

In Massachusetts probate, the original will is king. If the original can’t be located, or if it looks altered, you may end up in an expensive, slow “lost or destroyed will” detour. That detour invites arguments about whether the will was revoked, whether changes were made, and whether the document can be trusted. The easiest way to avoid that fight is simple: treat the original like evidence.

Handle like evidence

- Do not remove staples. Courts and clerks look at staple holes and impressions. If staples are removed and reattached, it can raise chain-of-custody questions. If you ever must separate pages to scan, talk to your attorney first so it can be documented properly.

- No handwritten edits. Pen marks, marginal notes, cross-outs, stickers, and “just one small change” invite litigation. If you want to change something, use a properly executed codicil or a fresh, updated document.

- Keep it clean and flat. Avoid folds, paperclips that dent signatures, coffee spills, heat or sunlight that can fade ink, and adhesives that leave residue. Use an archival sleeve or folder.

- Scan—but don’t substitute. Keep high‑quality scans for reference and sharing, but remember: a scan is not a replacement for the original will. For powers of attorney and health care documents, copies are often accepted, but many banks and hospitals still prefer to see originals or certified copies.

Where to store originals in Massachusetts

There is no one-size-fits-all answer, but the goal is the same: safe, accessible, and known.

- Fire‑rated home safe. Choose a fire/water‑resistant safe you can bolt down. Keep the combination where your Personal Representative (PR) and successor PR can access it without guesswork.

- Attorney vault. Many clients ask their attorney to hold the original will in a firm vault with a documented intake and release process. You keep the certified copy and location memo at home.

- Bank safe deposit box. This can work, but plan ahead for access. After death, your PR may need specific authority to open the box; make sure someone alive is a co‑signer, or that your PR can readily obtain the necessary authority.

- Digital backup (non‑substitute). Store encrypted PDFs of your plan in a secure digital vault (not as a replacement for originals) with instructions for access.

Who gets the originals vs. copies?

- Will: Keep the original secure (home safe or attorney vault). Provide copies to yourself and, if you wish, to the nominated PR in a sealed envelope marked “Copy—Do Not File.”

- Revocable trust: Keep the original with your will. Give your trustee a copy and provide a Certification/Certificate of Trust for transactions, so you don’t have to hand out the full trust.

- Durable Power of Attorney: Agents often need to show the original or a notarized/certified copy at banks. Keep one original handy; have your attorney produce certified copies.

- Health Care Proxy & HIPAA Authorization: Hospitals usually accept copies. Give copies to your agents and keep a set in your glove compartment and home.

Bottom line: if the court or a third party smells uncertainty—loose pages, staple marks, ink changes—your family inherits a headache. Keep originals pristine, and use properly executed updates instead of pen edits.

2) Who needs to know where things are (PRs, trustees, agents) and how to tell them

In an emergency, no one has time to hunt. Your plan works when the right people can find the right document fast. In Massachusetts, your Personal Representative (formerly “executor”) needs the original will to open probate efficiently. Your trustee needs the trust instrument (or a certificate) to manage assets. Your health care agent needs the proxy before a hospital asks for it.

Make a simple “Document Location Memo”

Create a one‑page memo listing each core document, where the original is kept, and how to access it: safe location, combination, key location, law firm contact, and names of people with access. Date it and keep it with your household binder.

- Will: “Original at Attorney’s office in vault; copy in home safe; PR and successor PR have copies.”

- Trust: “Original in vault; trustee has copy; Certificate of Trust in home safe and saved as PDF.”

- POA/Health Care: “Originals in home safe; agents have copies; PDFs saved in secure folder.”

Tell, don’t dump

You don’t need to hand out every page today. What your key people need is clarity and confidence:

- Personal Representative & successor PR: Tell them they’re named and where the will is. Provide your attorney’s contact. Let them know if there’s a safe deposit box.

- Trustee & successor trustee: Give a copy of the trust or at least a Certificate of Trust. Explain where the original resides and where to find asset schedules or summaries.

- Agents (health care & financial): Give copies and explain your preferences (end‑of‑life, living arrangements, who to call first).

Access planning: avoid day‑one roadblocks

- Safe deposit boxes: Verify who can access now, and who can access after death. If only you are on the box, your PR may face delay. Create a clear path.

- Home safes: Share the combination with your PR or store it in a sealed envelope with your attorney, to be released upon proof of death.

- Digital vaults: Use a reputable password manager to store PDFs and credentials; make sure your PR, trustee, or spouse knows how to obtain emergency access.

Practice tip: A brief family meeting can be helpful. You don’t have to disclose dollar amounts; simply tell people who will lead, where documents are, and how to reach your attorney. That ten‑minute conversation can save months of stress later.

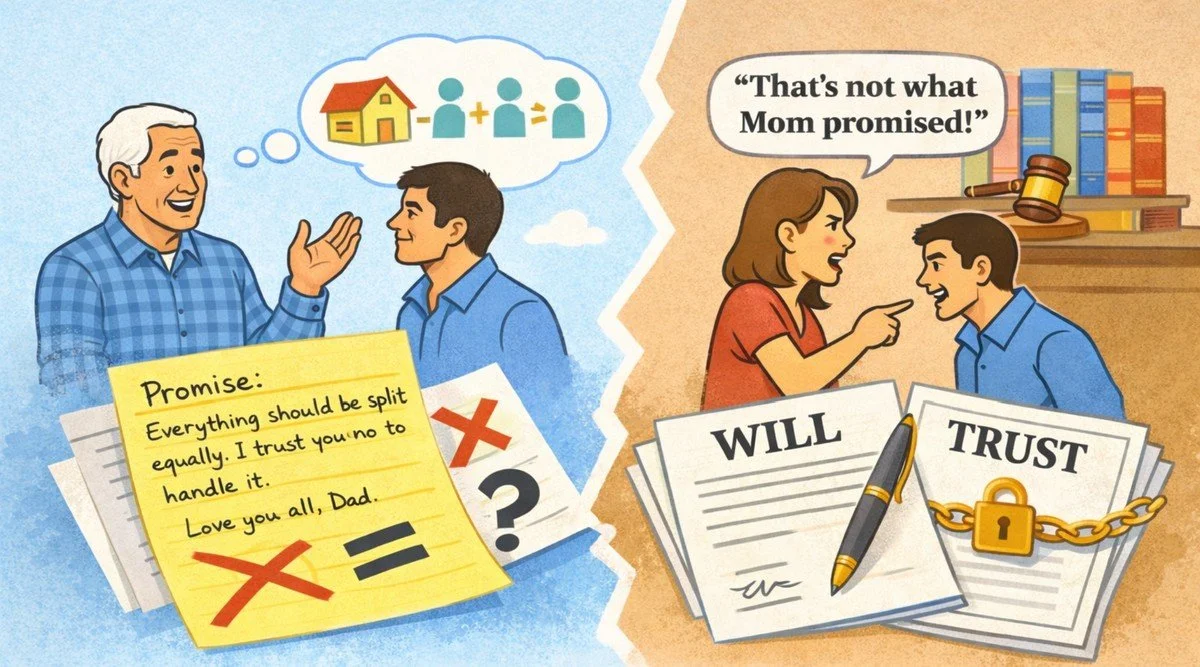

3) Reducing drama when the plan isn’t “equal”: making your will unassailable

Many Massachusetts families choose unequal inheritances for thoughtful reasons—special‑needs planning, prior gifts, second marriages, a family business that one child runs, or a wish to support a charity. Unequal doesn’t have to mean litigated. The goal is to make your plan clear, clean, and defensible, so the people you love aren’t put through a contest.

Execution that leaves no daylight

- Formal signing. Observe the execution formalities carefully, with neutral, disinterested witnesses. Keep the room calm, private, and free of potential influencers.

- Self‑proving package. Work with your attorney to include the customary acknowledgments so your will can be admitted without parading witnesses into court later.

- Original stays pristine. No staple removal, no page swaps, no sticky notes on signature pages.

Capacity and independence—show, don’t tell

- Independent advice. Meet with your attorney alone at least once. If a beneficiary drives you, have them wait outside.

- Contemporaneous notes. Good lawyering includes notes that you understood your assets, your family, and the effect of your plan. Those notes can matter if anyone later alleges incapacity.

- Optional statement. Where appropriate, a short, signed letter (kept with your documents) explaining your reasoning can defuse emotions. It isn’t controlling law, but it’s powerful context for your PR.

Design choices that reduce friction

- Use a trust when it helps. A properly funded revocable trust can streamline administration, reduce court exposure, and let you appoint a steady hand as trustee.

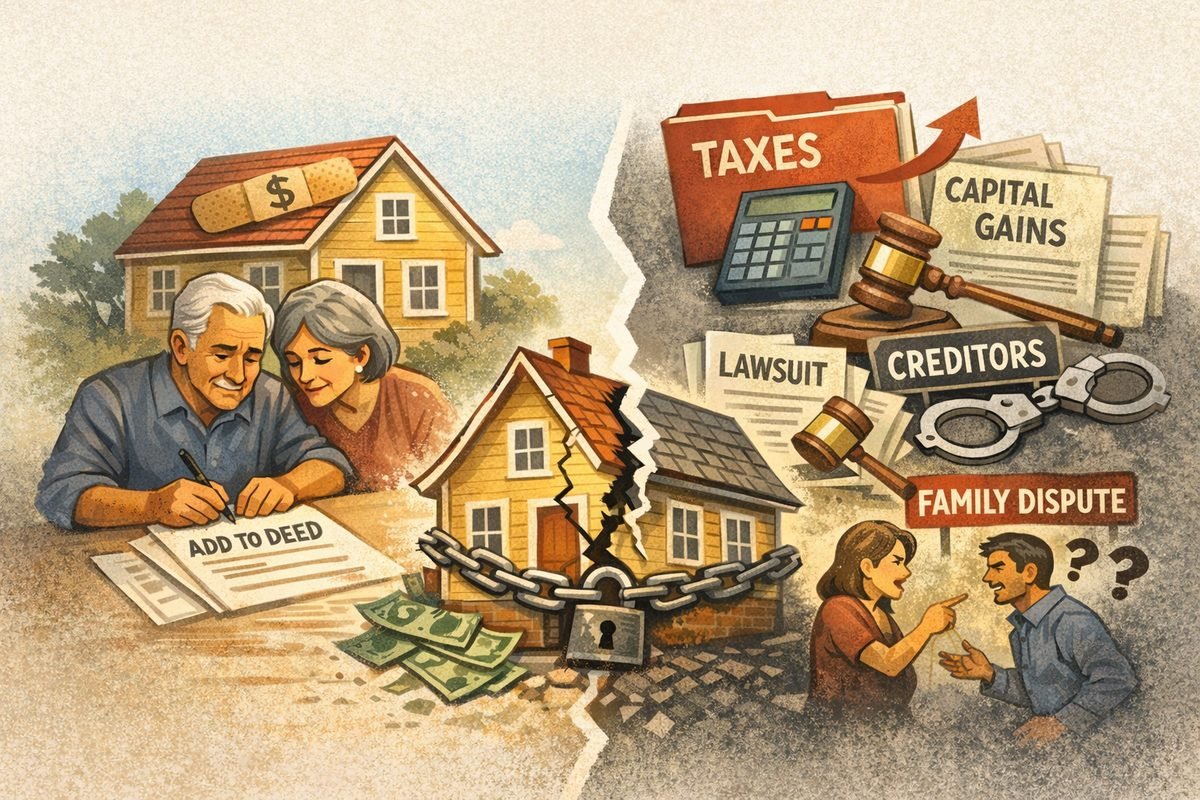

- Coordinate beneficiary designations. Make sure life insurance, retirement accounts, and transfer‑on‑death designations match the plan in your will or trust. Mismatches cause disputes.

- Consider a no‑contest clause. In appropriate cases, this can discourage meritless challenges. Discuss whether it fits your family and your plan.

- Communicate the basics. You don’t need to disclose shares or dollars, but a calm heads‑up that “the plan isn’t equal and that’s intentional” can lower the temperature later.

The test: Imagine your PR opening your safe the day after your death. Do they find a crisp, complete, obviously authentic set of documents that speak for you? Or a bundle of coffee‑stained pages with mystery staple holes and scribbles? The first scenario rarely gets contested.

4) Massachusetts timing: contests, capacity, and using notice the right way

Timing matters in Massachusetts. There are windows for challenging a will or a trust based on capacity or undue influence. Families sometimes lose rights because they wait too long—or they invite avoidable challenges because they didn’t give the right notices at the right time. Planning ahead can tighten those windows and make litigation less attractive.

Wills: how timing typically plays out

Once a will is submitted to the Probate and Family Court, interested parties are notified. From there, the clock begins to run for anyone who wants to challenge its validity. If the original will is clean and the process is handled promptly—using formal probate when appropriate—you reduce the opportunities for delay tactics. If the original can’t be found and you’re trying to probate a copy, expect a slower, more contested path.

Trusts: how to manage notice and shorten the contest window

Massachusetts trust law allows trustees to send written notice to beneficiaries and certain interested persons. Done correctly, this can significantly shorten the time available to challenge the trust on grounds like lack of capacity or undue influence. The details of that notice—what it must say and to whom it must go—should be handled by counsel so that the shortened window actually applies.

Should you record your trust?

Clients sometimes ask whether recording a trust (or parts of it) at the registry of deeds creates “public notice” that helps defeat late challenges. The tradeoffs are real:

- Privacy: Recording a full trust exposes family details and dispositive terms to the public. That’s usually unnecessary and rarely desirable.

- Practicality: For real estate, record a Certificate of Trust instead of the full document. It proves the trustee’s authority without revealing beneficiaries or shares.

- Strategy: If your goal is to start the clock on potential trust challenges, targeted written notice to the right people is typically more effective than recording the full trust. In some situations, counsel may recommend recording select excerpts or affidavits, but that’s a case‑by‑case decision.

Capacity concerns: head them off early

- Plan early. It’s much easier to defend planning done while you are clearly capable.

- Meet privately. Keep potential beneficiaries out of the room during discussions and signings.

- Be consistent. Make sure your will, trust, beneficiary designations, and property titles all tell the same story.

- Document. Your attorney’s file should reflect that you knew what you owned, who your family is, and what your plan does. That file is often the best antidote to later capacity claims.

Key point: Good notice practice shortens the contest window; clean originals and consistent documents reduce the appetite to challenge at all. You want both.

Final thoughts (and a gentle nudge)

If you forget everything else, remember this: pristine originals + clear access + clean execution = fewer problems. Most families don’t need to litigate. They need a plan that can be found fast, understood easily, and defended if someone stirs the pot. That’s what we build every day for Massachusetts clients.

If you’re unsure where your originals are, if staples were pulled for scanning, if your PR doesn’t know what a PR is, or if your plan isn’t “equal” and you’re worried about fallout, that nagging thought you feel is probably right: it’s time to review.

Take Action Today

Schedule a focused review with Nicholas S. Ratush, P.C. We’ll locate and safeguard your originals, align copies and access plans, and fortify your will and trust against avoidable challenges—Massachusetts‑style.

This article is educational and Massachusetts‑focused. It is not legal advice. Reading it does not create an attorney‑client relationship. For guidance on your specific situation, please contact our office.